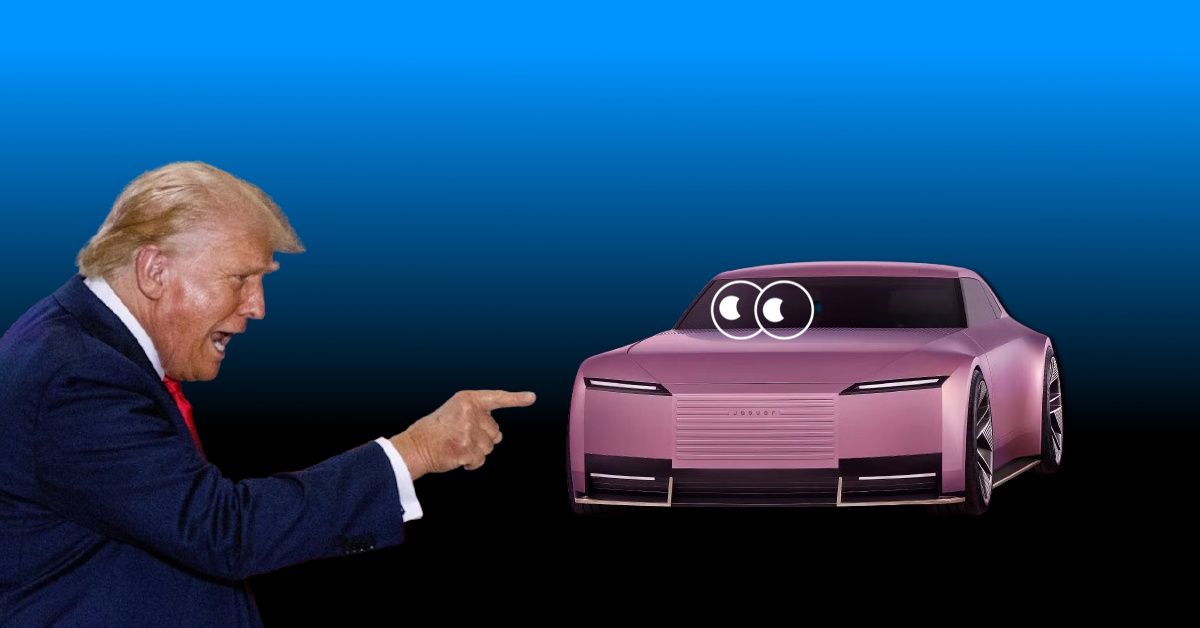

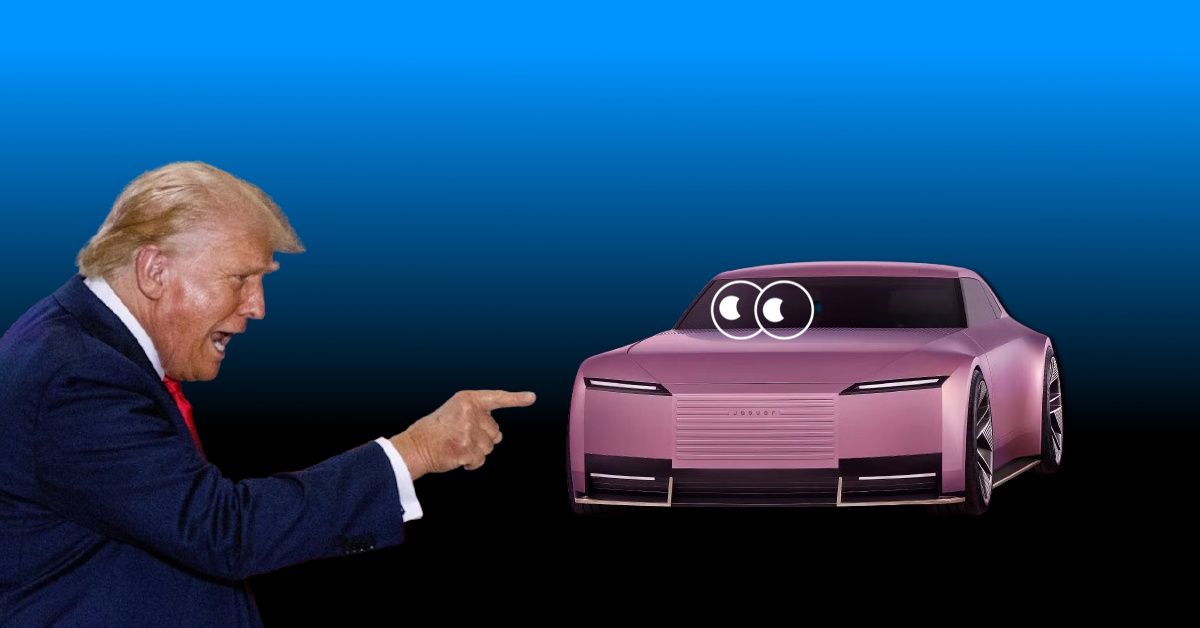

Trump Tariff Effect: Jaguar Land Rover Suspends US Exports

Jaguar Land Rover (JLR), the British luxury arm of India’s Tata Motors, has paused vehicle exports to the United States for at least a month in response to the newly imposed 25% import tariffs by the US government. This move illustrates the far-reaching impact of global trade policies on the automotive industry and reflects JLR’s strategic efforts to navigate both immediate disruption and long-term challenges.

The 25% tariff on imported vehicles, which came into effect on April 3, 2025, has prompted JLR to reassess its operations in the crucial North American market. The US accounts for nearly a quarter of JLR’s global sales—approximately 100,000 units annually—making it a key revenue driver. However, the steep tariff threatens to significantly erode profit margins.

In response, JLR has opted to temporarily suspend exports to the US. This pause serves multiple purposes. First, it gives the company time to rework its pricing strategy for American consumers, who could soon be paying significantly more for flagship models such as the Range Rover and Defender. Second, it allows JLR to make the most of its existing US inventory, which includes a healthy two-month supply of vehicles shipped prior to the tariff’s implementation. Lastly, the company is using this period to shift its focus toward alternative markets—especially India—where local assembly and sustained demand are creating new growth opportunities.

This strategic pause also follows a 17% year-on-year decline in JLR’s pre-tax quarterly profit reported earlier in the year, adding urgency to Tata Motors’ efforts to stabilize its luxury subsidiary.

Amid the turbulence in the US, JLR’s performance in India has emerged as a rare bright spot. The company’s “localise-to-optimise” strategy has paid dividends, fueling record-breaking growth in recent months. In the first half of FY2025, JLR India posted a 36% increase in sales, delivering 3,214 units. This surge was led by strong demand for the locally assembled Range Rover and Range Rover Sport.

Local production has also enabled the company to implement aggressive pricing. Indian buyers have seen price cuts of up to ₹44 lakh, a move that spurred a 60% spike in customer orders. Even fully imported models like the Defender saw a 75% rise in sales, reflecting the strength of the brand and the effectiveness of JLR’s India-specific offerings.

JLR India’s Managing Director, Rajan Amba, attributed the brand’s domestic momentum to its customer-centric strategies and special edition launches, such as the sold-out Range Rover SV Ranthambore Edition. This success has helped reduce JLR’s dependence on unpredictable export markets and positioned India as a vital buffer in turbulent times.

The US tariffs complicate Tata Motors’ ongoing turnaround strategy for JLR, which remains a cornerstone of the group’s revenue. The risks are considerable. According to industry estimates, the tariffs could potentially wipe out up to 24% of JLR’s EBITDA in a worst-case scenario. The announcement of the tariffs triggered market unease, causing shares of Tata Motors and other Indian exporters to dip.

Additionally, JLR’s global supply chain—anchored in the UK, where it employs 38,000 people—is facing fresh uncertainty. However, the company retains a degree of flexibility thanks to manufacturing facilities in Slovakia and India.

Despite the challenges, there are reasons for optimism. JLR’s “Reimagine Strategy,” a bold £15 billion electrification initiative, is progressing steadily. The upcoming launch of the Range Rover Electric, which has already received 57,000 pre-orders, and ongoing development of hydrogen fuel-cell technology, are key elements of this future-proofing plan.

In the short term, JLR is implementing cost-cutting measures, particularly in marketing, and is exploring price increases for US consumers to offset the tariff impact. However, long-term resilience will depend on several strategic pivots.

First, accelerating electrification remains a top priority. This not only aligns with global trends in electric vehicle adoption but also helps the company offset emissions penalties. Second, boosting local production—in markets like India—reduces exposure to trade barriers and improves pricing flexibility. Finally, diversifying its market footprint by expanding in Asia and Europe can help JLR counterbalance volatility in the US.

Analysts caution that if tariffs remain in place for an extended period, JLR’s break-even point could rise, placing additional strain on operations. Nonetheless, the company is in a relatively strong financial position, with an estimated £1.3 billion in free cash flow for FY2025 providing a buffer against short-term headwinds.

The “Trump Effect” has highlighted the vulnerability of globalized automotive supply chains. For JLR, the export pause is a tactical retreat, not a strategic defeat. By capitalizing on India’s growth and committing to a future led by electrification and innovation, Tata Motors is steering its luxury marque through one of the most challenging phases in recent memory.

As JLR’s leadership has repeatedly emphasized, the “Reimagine Strategy” is about redefining sustainable luxury in a way that transcends borders. For now, however, those very borders have become a significant obstacle—and navigating them will define the company’s path forward.