Tata Motors MD's Warning Shot: Hybrid Incentives Are Slowing Down Electric Cars' Progress

Tata Motors, India's biggest electric vehicle manufacturer, has raised a red flag over a growing policy paradox. Shailesh Chandra, the Managing Director of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, recently pointed out that government tax benefits offered to hybrid vehicles are stalling the momentum of electric vehicle adoption. The claim is not just a defensive reaction from an EV pioneer but a deeper reflection of how shifting incentives could tilt the market away from full electrification.

This concern comes at a time when EV growth, which saw record-breaking volumes in 2023, is beginning to flatten in 2024, particularly in the passenger car segment. Meanwhile, hybrid cars—especially strong hybrids from Japanese automakers—have gained significant traction due to their lower effective cost after taxation and attractive fuel efficiency numbers.

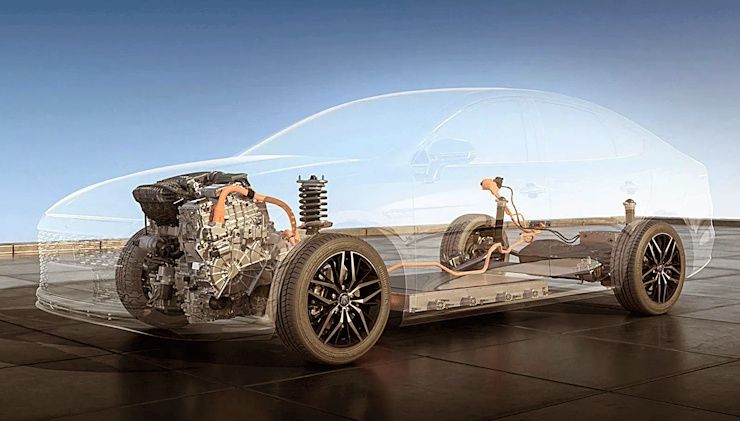

Hybrid vehicles currently enjoy a much lower GST rate of 5 percent on some components, compared to the 43 percent levied on petrol and diesel cars. While EVs also benefit from a 5 percent GST, Tata Motors argues that hybrids are inadvertently getting a free ride. This is because hybrids do not require the same infrastructure investment as EVs and still rely on fossil fuels.

The situation is complicated further by the fact that many buyers, especially in metro cities, are leaning toward hybrids as a transitional choice. Vehicles like the Toyota Hyryder, Maruti Grand Vitara, and Honda City e:HEV offer an extended driving range without the stress of range anxiety. These are practical benefits that pure EVs are still catching up to, especially with charging infrastructure being patchy beyond Tier 1 cities.

Tata has invested heavily in its EV lineup, which includes the Nexon EV, Tiago EV, and Punch EV. But despite being early movers, the brand is starting to see the pace of adoption slow. The company’s anxiety is not misplaced. In the last financial year, strong hybrids have eaten into the market share of petrol and diesel cars, but now they are also encroaching on the early gains made by EVs.

Hybrids offer consumers the psychological comfort of not being entirely dependent on charging stations. Combine that with favourable taxation and a perceived ‘eco-friendly’ image, and the buyer is easily swayed.

Tata Motors is now lobbying for a reassessment of the policy framework. The core of its argument is simple: if the objective is long-term decarbonisation, then EVs, not hybrids, should receive the lion’s share of incentives. From a lifecycle emission standpoint, battery EVs have lower emissions than even the best strong hybrids.

There’s also the question of local value addition. Tata has made efforts to localise EV components and batteries, while most strong hybrid components, particularly the power control units and motors—are imported. This makes the current structure counterintuitive for building domestic capability in EVs.

India’s policy architects now find themselves in a tight spot. On one side is the need to increase green mobility penetration quickly, for which hybrids offer a low-hanging fruit. On the other side is the long-term roadmap to pure electric mobility and energy security. The hybrid incentive structure, while helping reduce fuel imports in the short term, risks becoming a crutch that slows down EV investment and infrastructure development.

Unless the policy is recalibrated, automakers who have invested in EVs may find themselves penalised for moving early. This could impact not just Tata but also newer players like Mahindra, MG, and Hyundai who are planning significant EV launches over the next few years.

For consumers, the short-term outcome might be more choices and aggressive pricing as EV makers respond to the hybrid wave. But in the medium term, this could result in slower infrastructure growth, inconsistent policy signals, and confusion over which technology to back.

Tata’s strong message underscores a bigger question for the industry: is India chasing short-term efficiency or long-term sustainability? And as the debate intensifies, the answer may shape not just buying decisions but the future of clean mobility itself.

Via ACP